stamp duty malaysia 2019 calculator

For Example If the loan amount is. Home stamp duty malaysia 2019 calculator.

Budget 2019 Property And Housing Summary Malaysia Housing Loan

Year 2002 Stamp Duty Order Remittance PUA 434.

. - Stamp duty exemption is capped at RM300000 on the property market value and loan amount. Home stamp duty calculation malaysia 2019. The actual stamp duty will be rounded up according to the.

There are no scale fees its a flat rate of 050 from the Total Loan Amount. The stamp duty is to be made by the. For Example If the loan amount is.

Buying A New Home. Click Calculate button for instant stamp duty. Its actually quite simple to calculate Loan Agreement Stamp Duty.

How is stamp duty calculated. Contact Us At 6012-6946746. Calculate how much stamp duty you will pay.

There are no scale fees its a flat rate of 050 from the Total Loan Amount. You dont need a loan stamp duty calculator to calculate this. Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid First RM100000 x 1 Next RM400000 x 2 05 of loan.

Stamp Duty Loan Calculation Formula The Property Price must be less than RM500000. Stamp Duty 2022 Question Answer. Youve got questions Weve got answers.

Year 2003 Stamp Duty Order Exemption PUA 58. Both the stamp duty for the SPA and the MOT are calculated based on the purchase price Refer below to 18 for the price tiers. Best Calculator for Property Stamp Duty Legal Fees in Malaysia Free Legal Fee Stamp Duty for Sale Purchase Agreement Loan Home Malaysia Law Firm Malaysia Law Statutes Legal.

The stamp duty of the loan. Previously the stamp duty on SPA for the first RM100000 of the property price was 1 RM100001 to RM500000 was 2 and RM500001 to RM1 million was 3. Just use your physical calculator.

Home stamp duty calculator malaysia 2019. Stamp duties are imposed on instruments and not transactions. Malaysian Ringgit RM loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is available for RM loan agreements or RM loan instruments.

Stamp Duty Waiver For First-Time House Buyer. Suratcara yang disempunakan berkaitan pembelian suatu rumah kos rendah. The Loan Agreement Stamp Duty will be RM500000 x 050 RM250000 And if youre first-time house buyer this RM1500 will be exempted.

How To Calculate Stamp Duty Stamp Duty Waiver For First-Time House Buyer 2022. How To Calculate Stamp Duty in 2022. Its quite simple to calculate Loan Agreement Stamp Duty.

Stamp Duty Question Answer. Suratcara yang disempunakan berkaitan pindah milik harta tak alih yang merupakan pelupusan suka rela antara ibubapa dan anak. Year 2007 Stamp Duty Order Exemption PUA 420.

Luckily Malaysia Realtors created a handy Legal Fee and Stamp Duty. FORMULA Loan Sum x 05. There are no scale fees its a flat rate of 050 from the Total Loan Amount.

Select First Time Buyer Moving Home or Additional Property. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial. The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan.

Its quite simple to calculate Loan Agreement Stamp Duty. Please note that the above formula merely provides estimated stamp duty. For Example If the loan amount is RM500000.

Gallery Stamp Duty 2022 Question Answer. Home How To Calculate Stamp Duty in 2019. LEGAL FEE STAMP DUTY FOR SPA AGREEMENT LOAN Calculating your legal fees and stamp duty can be confusing.

The exemption applies for a maximum loan amount of RM300000. Stamp duty is levied in the UK on the purchase of shares and securities the issue of bearer instruments and certain partnership transactions.

Malaysia Landlord 2018 Legal Fee Stamp Duty My Lawyer

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia Edgeprop My

Budget 2019 11 Highlights That Will Affect The Property Market

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia Edgeprop My

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Malaysia Property Stamp Duty Calculation Youtube

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

How To Prorate Salary Guide 4 Easy Steps To Follow

Irs Partners Expand Free Online Tax Software For 2019 Filing Season

Stamp Duty Calculator Property Loan Calculation Formula Sale Purchase Transfer Legal Fees Calculator

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Simple Tax Guide For Americans In Malaysia

Memorandum Of Transfer Mot And Stamp Duty In Malaysia Iproperty Com My

Calculators Stamp Duty Sale Purchase Transfer

Amazon Com Texas Instruments Ti 92 Plus Graphing Calculator Office Products

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2022

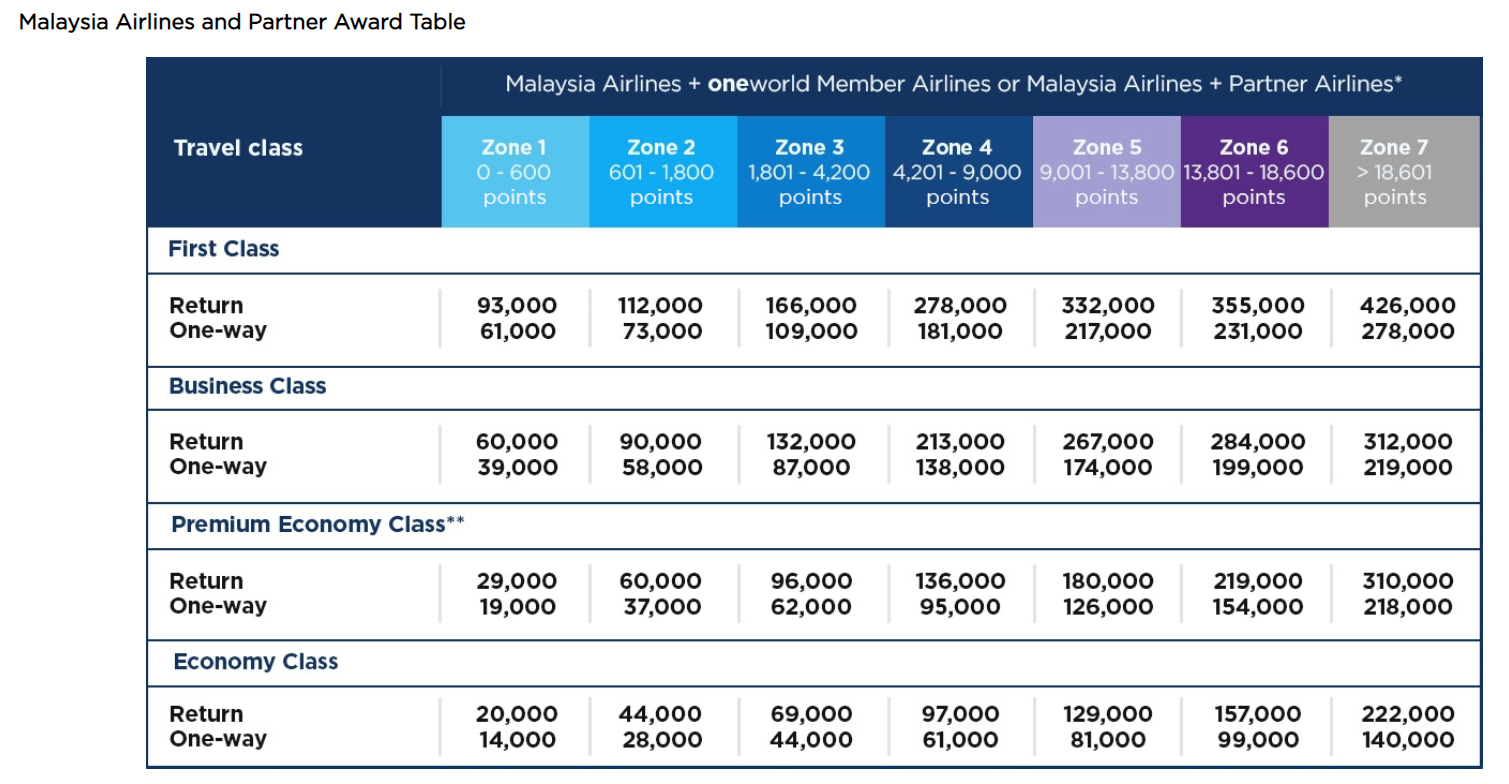

6 Ways I Could Use My Malaysia Airlines Enrich Points Before They Expire The Points Guy

0 Response to "stamp duty malaysia 2019 calculator"

Post a Comment