epf withdrawal i sinar

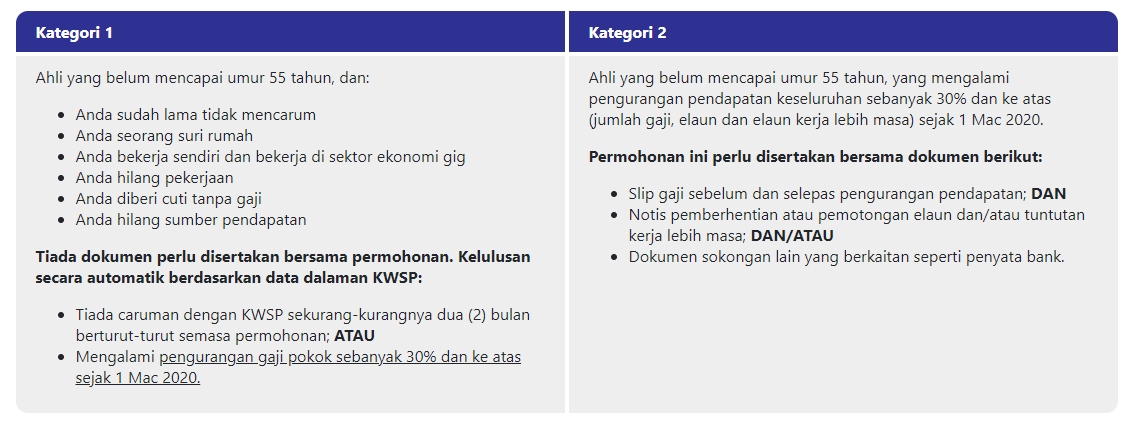

Originally the i-Sinar programme was only catered to EPF members who suffered pay cuts or lost their jobs during the pandemic. For members who fulfil the criteria their application will be approved automaticallyOnly confirmation.

Epf Issues Sombre Reminder Of Retirement Crisis Risk Ahead Of Another Special Withdrawal On April 1

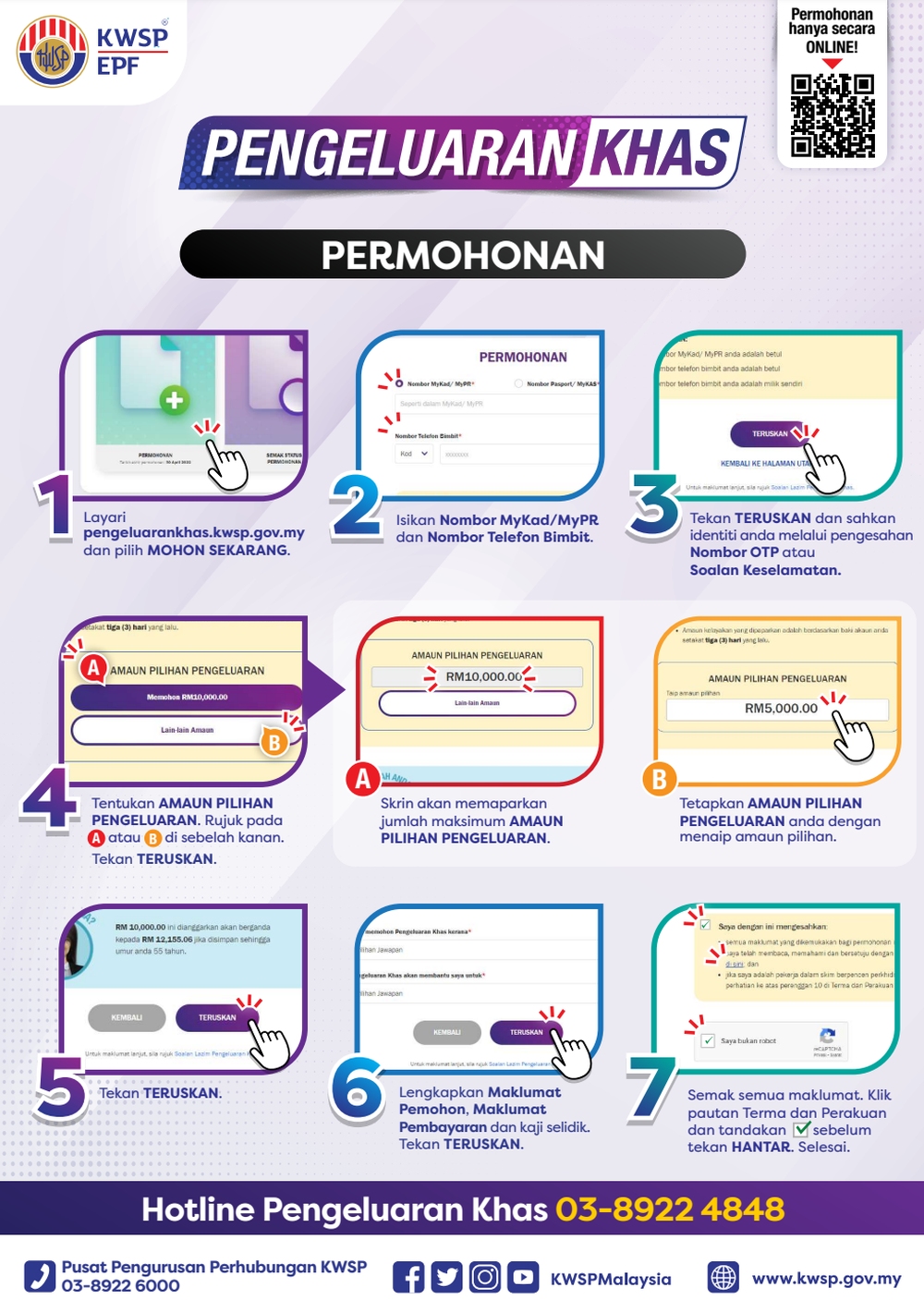

EPF mmembers can mafe the withdrawal at httpspengeluarankhaskwspgovmy through the i-Account starting 1 April.

. Online applications beginning 21 December 2020. The Employees Provident Fund EPF is in the process of lifting several conditions for the i-Sinar withdrawal facility which among others will allow contributors under the age of 55 to withdraw from their Account 1 funds. The withdrawal amount will vary depending on.

Calling the scheme i-Sinar the initiative aims to relieve the financial burdens of EPF members whose livelihoods have been affected by the COVID-19 pandemic. As at 4 January 2021 the Employees Provident Fund EPF has approved 25 million out of a total of 388 million applications for i-Sinar which has been open for submissions under Category 1 since 21 December 2020The current total approved withdrawal amount is RM1962 billion with the first months payout. The Employees Provident Fund EPF has provided fuller explanation on the i-Sinar withdrawal facility as set out below.

It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021. However the amount withdrawn will be subject to the account balance. The latest withdrawal showed that only eight per cent of the EPF members which withdrew their savings have less than RM1000 in the account.

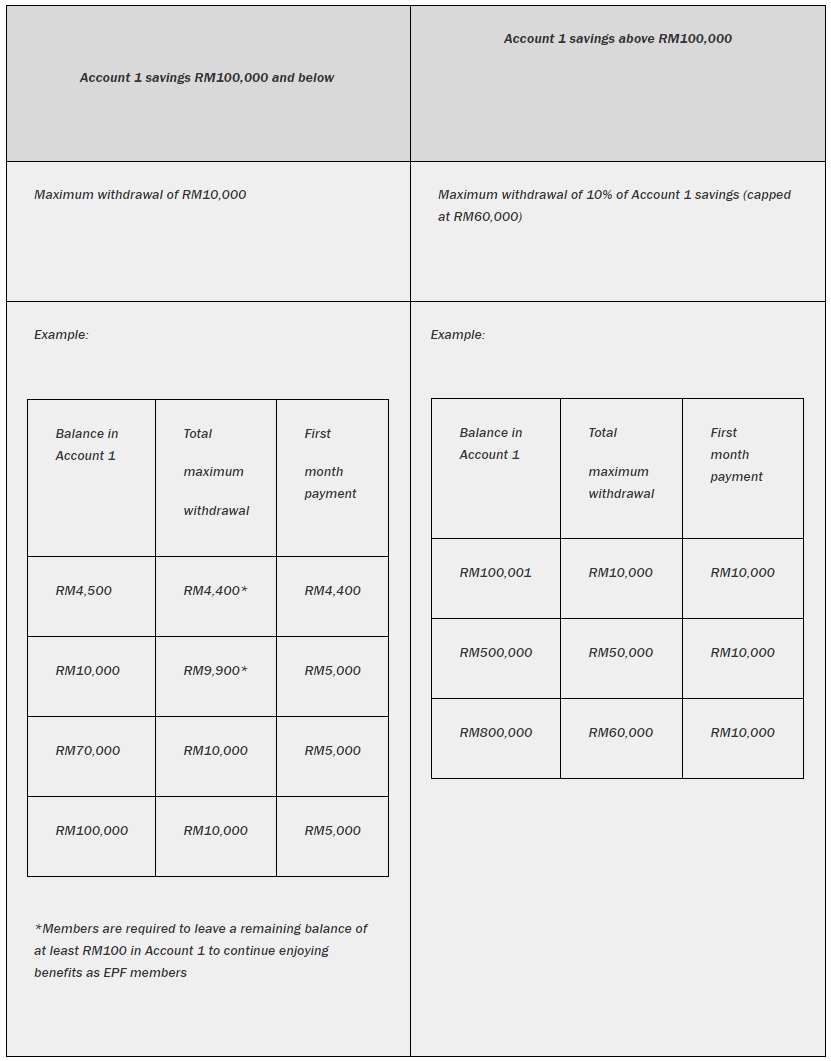

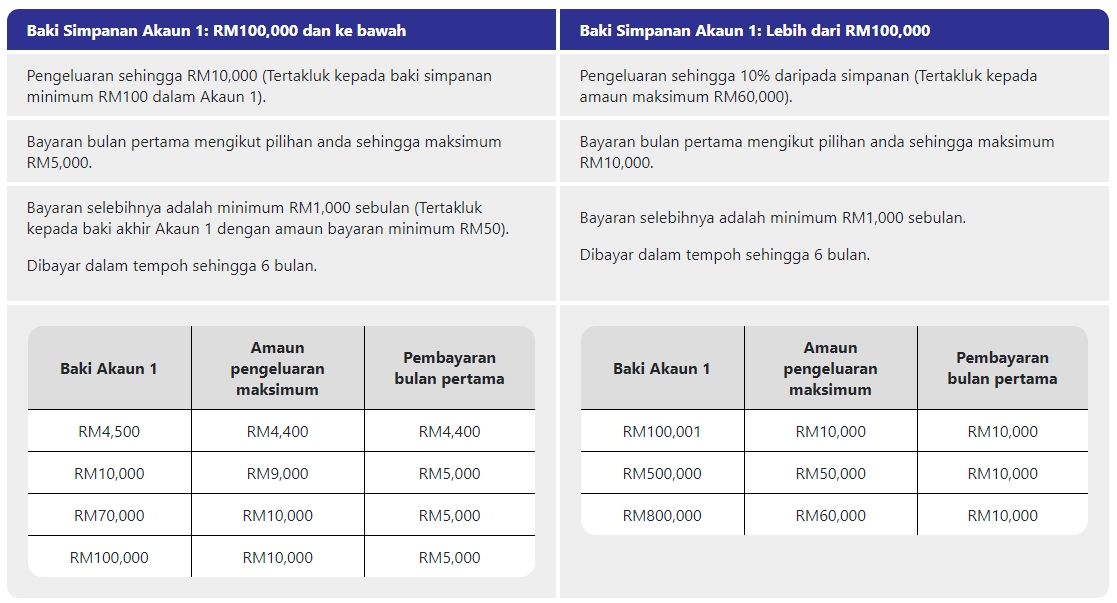

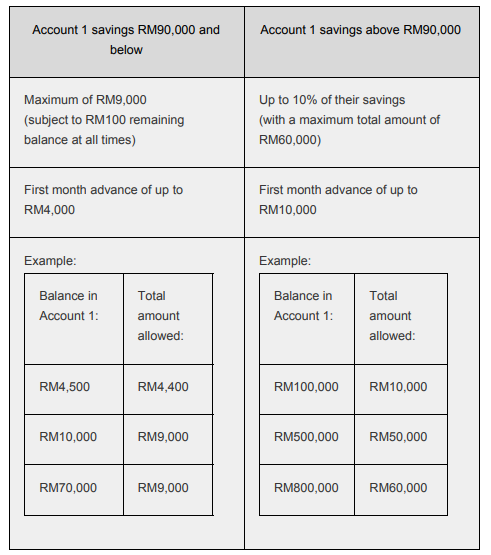

As shown in the above example the withdrawal will fully utilise Account 2 first before utilising Account. Through the facility which expects to benefit half of its 14 million contributors members can withdraw up to RM60000 from their account one. With the announcement i-Sinar will benefit 2 million eligible members and result in a total.

Eligible members can apply to withdraw from a minimum of RM50 to a maximum of RM10000. According to EPF this caused 61 million members to have less than RM 10000 in their savings and a. Though the i-Sinar facility is a helpful.

According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. The Employees Provident Fund EPF announces the criteria and details of the i-Sinar facility which is now open to up to 8 million eligible members. KUALA LUMPUR 6 January 2021.

The move will benefit some eight million EPF contributors Finance Minister Tengku Zafrul Aziz said in the Dewan Rakyat today. Affected members who wish to take out funds are able. The government has announced an extension of its i-Sinar programme to allow all Malaysians to withdraw funds from Account 1 of the Employees Provident Fund EPF.

The EPF has allocated RM70 billion for the initiative which is expected to benefit eight million members who can. EPF i-Sinar or i-Sinar KWSP was announced as a part of the government scheme to support Malaysians who were financially hit by the pandemic allowing eligible members to withdraw a set amount of funds from their respective accounts. The Employees Provident Fund EPF has revealed full details for the i-Sinar program which will allow eligible members to make withdrawals from Account 1.

However there must be at least RM100 remaining in Account 1 after the withdrawal. They could decide to withdraw a certain amount of money from their Account 1. Total Withdrawals Allowed.

The i-Sinar program was introduced to assist members who are affected by the current pandemic situation. The move will involve some RM70 billion from the. KUALA LUMPUR 2 December 2020.

1Withdraw 20k i-sinar 2Follow TS stock purchase recommendation 3Bursa open all in 4Google search top 10 places to 14th floor. Do take note that. EPF full withdrawal I Sinar 20 Bantu rakyat dengan duit rakyat.

They have to withdraw from the savings balance in their Account 2 before accessing the savings in Account 1. However in February 2021 the government announced that the i-Sinar is now expanded to all EPF members. The eligibility criteria is as follows.

This initiative was launched by the EPF for the purpose of easing the financial burden of members whove been affected by the Covid-19 pandemic helping them sustain their livelihood. During the past two years Malaysians have been allowed to make several rounds of withdrawals from their EPF savings through i-Lestari i-Sinar and i-Citra schemes which resulted in a withdrawal of RM 101 billion by 74 million members. Eligible members include workers in the formal sector self-employed workers and workers in the gig economy.

Total withdrawal of RM1962 billion. According to EPF this is to maintain the status of an active member. The process of verification is required to avoid fraud and improper withdrawal of i-Sinar funds by third parties.

Jun 7 2021 1020 AM updated 2w ago. The proposal to allow EPF members to withdraw savings from Account 1 was brought up in late October and it sparked serious discussions among financial experts employers government officials and the opposition. Despite the convenience offered the facility is not a withdrawal or a form of free cash because EPF members still need to replace the funds later.

EPF members are allowed to withdraw a maximum amount of RM10000 and a minimum of RM50. What this means is that the majority of the withdrawals were made by the M40 and T20 income groups who have enough savings in their EPF account whereas the remaining B40 were unable to do so due to the. The EPF i-Sinar initiative enables EPF members to make a partial withdrawal from their savings in EPF Account 1.

Takaful Household Plan Protection Plans How To Plan Protection

Image The Star Survival Animal Spirit Cards Retirement Fund

Epf Approves Rm19 62 Billion Worth I Sinar Applications Businesstoday

Need To Withdraw More Funds Epf I Sinar Applications Can Now Be Amended Online

Here S How You Can Get Access To Your Epf Account 1 Hr News

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Why I Sinar Went Wrong And Why Epf Contributors Shouldn T Be Treated Like White Knights Consumers Association Penang

Image The Star Survival Animal Spirit Cards Retirement Fund

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Those Withdrawing From Epf Without A Good Reason Must Pay 2 5 In Zakat

Rm10 000 Epf Special Withdrawal Everything You Need To Know Soyacincau

I Sinar Withdrawal A Case Of Desperate Times Calling For Desperate Measures Now And Also In The Future Businesstoday

Epf I Sinar Unconditional Withdrawal Should You Withdraw From Epf Youtube

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf Member To Withdraw From I Sinar Account Swoon Lea

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Nestia

How To Withdraw From Epf Under I Sinar Home Buying Emergency Savings Petaling Jaya

0 Response to "epf withdrawal i sinar"

Post a Comment